The Rise of Inflation

Bursting the bubble

Rebecca L. Spang

Inflation. People fear it, policymakers dread it, pundits pronounce upon it. It was high throughout the West in the 1960s, higher in the 1970s, and hyper in the aftermath of World War I. Inflation could rise again.

But how do we know when inflation rises or falls? Who measures inflation and what tools do they use? In 1996, annual inflation in the US was reported to be under 3 percent, yet 84 percent of Americans thought that controlling inflation was “the most important” issue facing economic policymakers. In spring 2013, the European Union’s annual inflation rate was 1.4 percent and yet 67 percent of Europeans said that rising prices were a “very big” concern.[1]

What are people so afraid of? What, in short, is inflation? Is it anything at all? Or has “inflation” been puffed and blown up, swelling balloon-like with air? Dr. Johnson’s Dictionary of the English Language (1755) defined “inflation” as “the state of being swelled with wind, flatulence.” In its sole appearance in Diderot and D’Alembert’s Encyclopédie (1751–1772), the word explained how the flageolet (a small woodwind instrument) made music. If other authors used the word more frequently than did lexicographers and encyclopedists, they did so chiefly to describe medical conditions. Inflation could be good or bad; it could be the healthy state of functioning lungs or it could be a tumorous sign of disease, but in either case it had nothing to do with money or prices. Filled with air or with fluid, an inflation was a temporary condition—this is why John Howe’s The Blessedness of the Righteous contrasted true Christian happiness, “a modest humble exaltation,” with more visible shows of joy which were but “big by an Inflation or a light and windy Tumor.”

Decades later, scientists found more permanent inflations to be diagnostically useful. When the paleontologist, Edward D. Cope, wrote in 1882 of the “degree and form of inflation,” he was referring not to the rising price of fossils but to the extent and shape of the auditory bulla in various extinct carnivores.[2] Cope, his rival Othniel Charles Marsh at the American Museum of Natural History, their predecessor Louis Agassiz at the Museum of Comparative Zoology (Harvard), and all their students—all of these men wrote authoritatively about “inflations” in the English-speaking nineteenth-century world. Be the topic chameleons’ tongues, sponge anatomy, or scarlet fever’s effects, “inflation” was a word known chiefly in medical and natural-historical circles.[3]

It was only in the 1860s that the word “inflation” began to be used in an economic context and then with a meaning quite different from the one it has today. The North and the South fought the Civil War much as the American colonists had fought the redcoats (and as French revolutionaries had battled the forces of absolutist monarchy): with men, guns, and fiat currency (so called because much as God said, “Fiat lux” and there was light, so governments said, “Let there be money”). At the start of the conflict, the United States Treasury had approximately two million dollars at its disposal (the war cost roughly 125 times that amount) and the Confederacy’s coffers were empty.[4] Both sides issued paper, but the Confederacy’s key doctrine of states’ rights meant it did little to enforce its currency’s acceptance. While Southerners were invited to accept Confederate dollars as a show of patriotic support, no one was obliged to take them. Since the same ideology also meant that the Confederacy collected no “national” taxes, the South had no promise of future income backing its currency.

Instead, the whole monetary system depended on individuals’ estimation of the likelihood of Confederate victory. As long as its early military successes continued, Southerners accepted the Confederacy’s bills at face value. But when the Union occupied New Orleans and the commanding general prohibited the use of Confederate money, faith in the paper quickly began to collapse.[5] In the North, where the federal government collected the usual excise duties and stamp taxes (and imposed an emergency income tax), the guaranteed revenue stream helped ensure that the greenbacks held their value somewhat better than the competing greybacks. Moreover, the Union won the war. At its end (and despite the North’s victory), goods purchased with greenbacks sold for roughly four times the price of the same items paid for in coins or in bank-issued notes. Critics accused the Lincoln administration of “inflating” the country’s money supply—puffing it up overnight with temporary paper.

When it entered economic usage, then, “inflation” referred not to rising prices but to expanded supplies of money. Debate raged over whether “inflation” (what we today call “stimulus” or “quantitative easing”) would or would not increase prices, but in this period when “inflation” did not necessarily mean rising prices, the relationship could be thought in various ways. As long as it meant “increased availability of money,” inflation could be understood as facilitating trade, encouraging investment, and even benefiting the poor. Moralizing critics could worry about the corrupting effects of “easy money” on society but policy enthusiasts could counter that more currency in circulation would make it easier for borrowers to pay off their debts. Lawmakers could even be “pro-inflation.”

Consider, for instance, responses to the Long Depression that followed the panic of 1873. As credit dried up, commerce and industry collapsed. Jobs disappeared and farmers sold their harvests at a loss. While the Christian press described the crisis as divine punishment, others proposed that the situation could be reversed if only money were not in such short supply. “Western” senators and representatives (that is, those from Indiana, Illinois, and Pennsylvania—geography, like economics, is not exempt from time and history) called on the federal government to make more money available. They pushed hard to get an “Inflation Bill” through Congress and rejoiced at its passing in spring 1874. When President Ulysses S. Grant turned on his fellow Republicans and vetoed it, the “inflationists” were in shock. Did the general really want the United States to continue in its sad, deflated condition? Had not the “Contraction Act” of 1866—which withdrew at least 20 percent of the greenbacks in circulation—done enough to knock the wind out of America? Had not the greenbacks served the United States just as valiantly as the bluebellies? In the words of one inflationist, “We are apt to forget that the ‘Continental money’ secured for us a country and the ‘greenback’ currency has saved for us a nation.” Or, as another said: “Why should this Grand and Glorious country be stunted and dwarfed … its life blood curdled … by [opposition to paper money]?”[6]

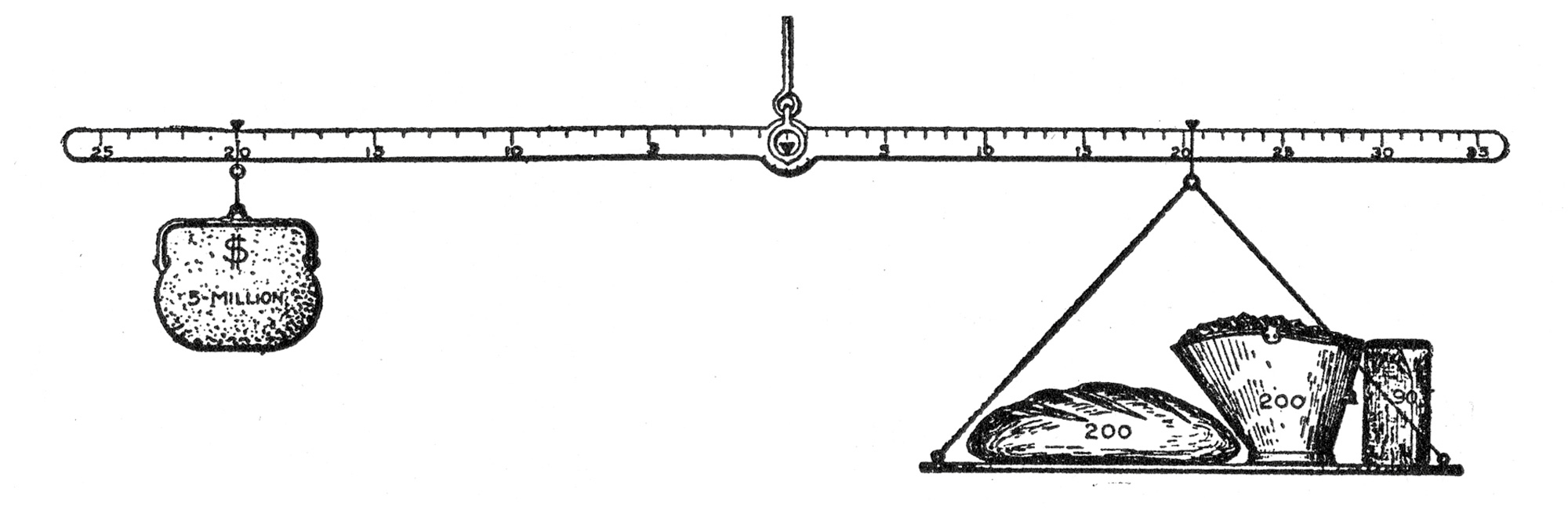

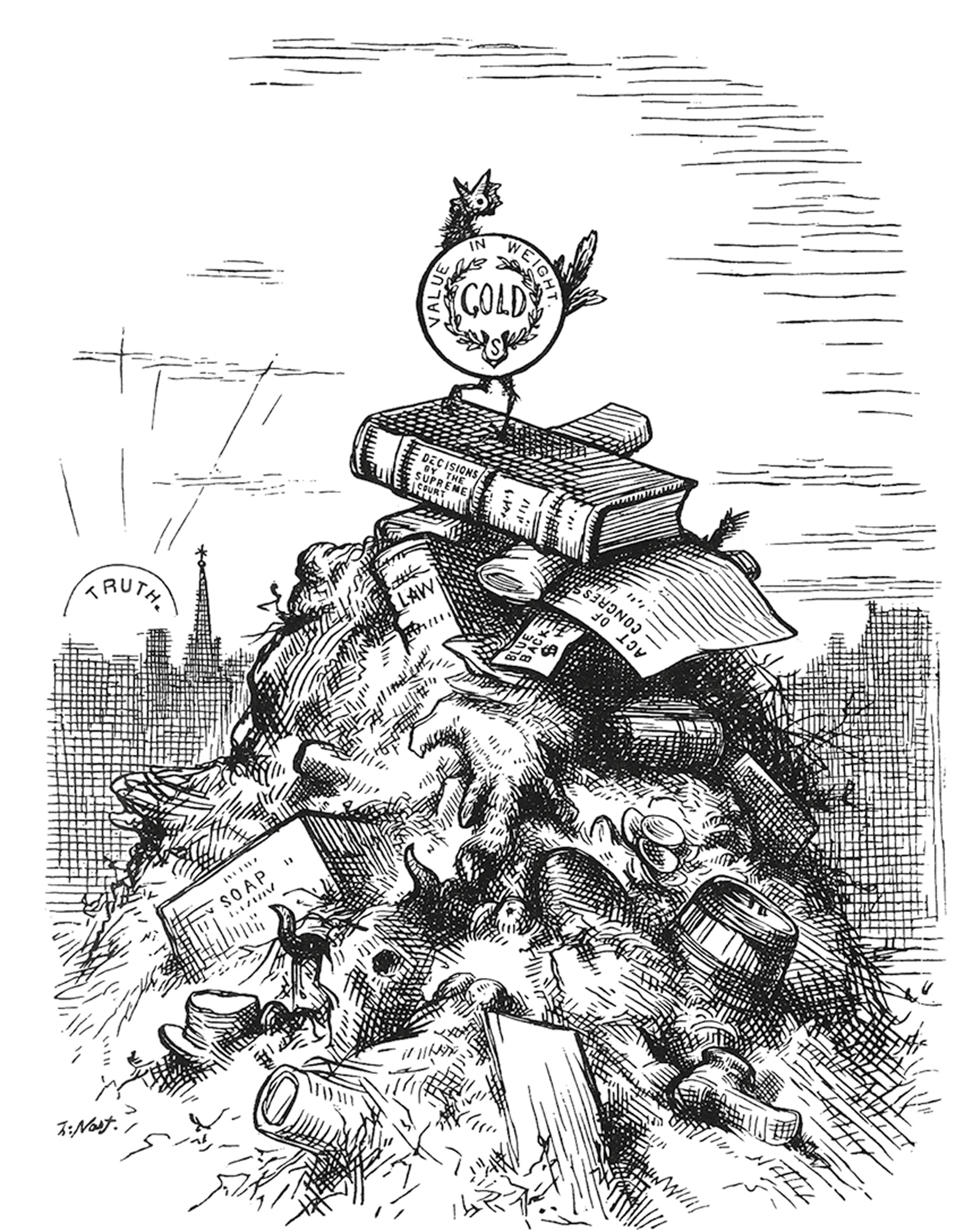

Respiratory allegories and circulatory imagery dominated the following decades, as “hard money” men—committed to the idea that money should have an “intrinsic” value and a quantity limited by the availability of gold—charged their “soft,” Greenbacker or Silver Party antagonists with misunderstanding the ills besetting America. Andrew Dickson White, first president of Cornell University and a former history professor at the University of Michigan, for instance, spared no metaphor as he depicted the dangers of liquid wealth too easily come by. Paper money, he wrote, was “clamored for as a new dram is called for by a drunkard”; it was a “corrosive poison [that] ate out the vitals of [national] prosperity”; it was brought into existence by the “rising tide” and “current” of vulgar opinion; it was sure to wash everything away in a flood of destruction.[7] Making regular use of the vocabulary of the physical and medical sciences, White and other goldbugs insisted that money and value had to have a natural basis. They scoffed at opponents who argued money was not a natural, but a social and political phenomenon; they hailed gold’s eventual triumph as “the survival of the fittest”; and they mocked the idea that Congress—or anybody else—could make paper into money (an act often compared to making a rag doll into a living baby).

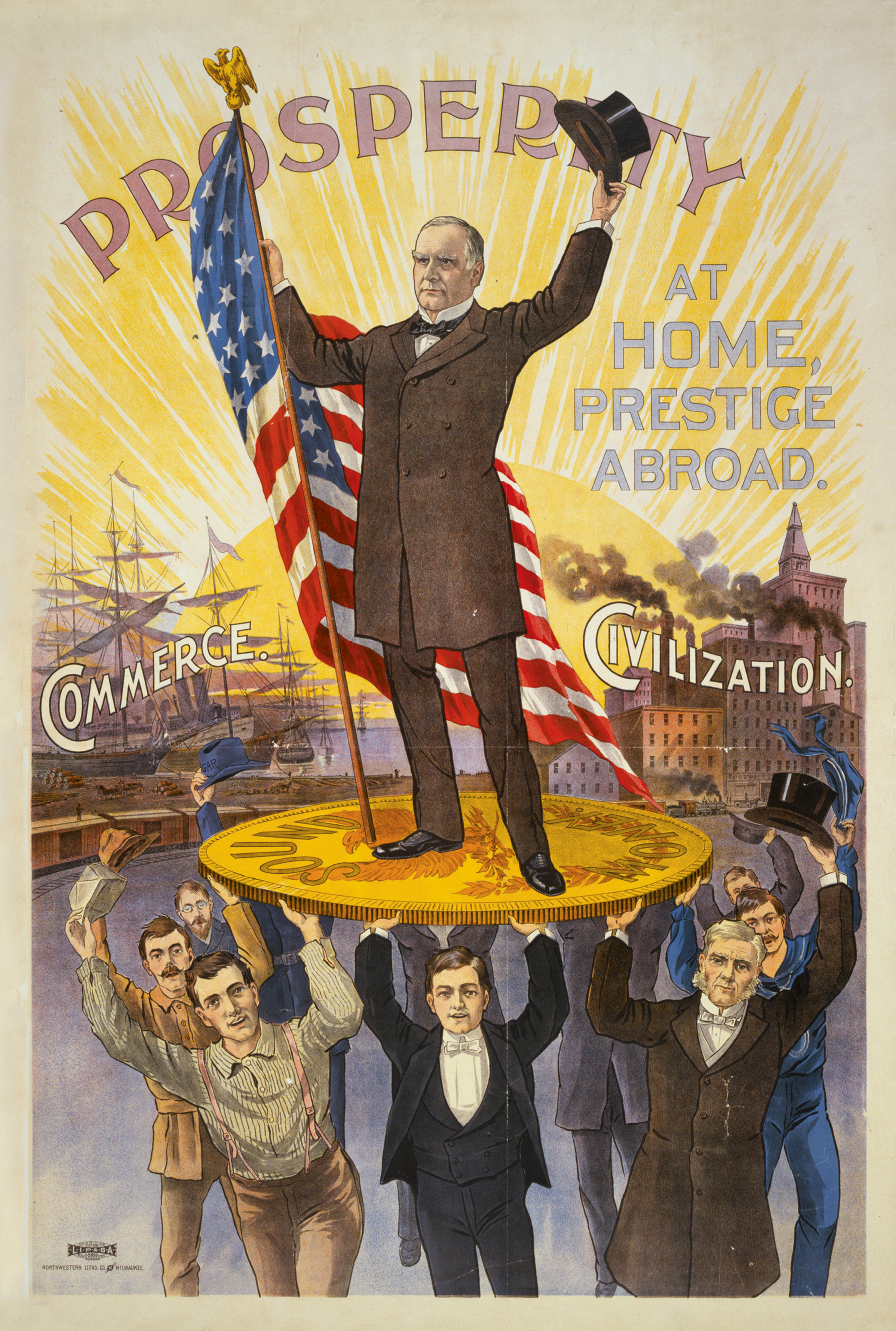

There was, said the goldbugs, a science to money, its laws as invariable as those of physics. In a series of columns, the editors of The Nation made it clear that those who advocated soft, paper money knew nothing of “hard” science. Inflationists were “Sioux who do not believe an astronomer can measure the distance to the moon”; they were like a “Chinaman beating a gong to get the dragon to stop eclipsing the sun”; their arguments were as “disgraceful and ridiculous in our day and generation” as it would be to “go about trying to persuade people that the sun goes around the earth.”[8] When William McKinley defeated William Jennings Bryan in the 1896 presidential election, inflationism seemed for a time deflated.

With Irving Fisher (1867–1947)—professor of economics, committed prohibitionist, proselytizing vegetarian, and first president of the American Eugenics Society—the science of money became mathematical. Noting that “an algebraic statement is usually a good safeguard against loose reasoning; and loose reasoning is chiefly responsible for the suspicion under which economic theories have frequently fallen,” Fisher produced one of the most famous equations of the twentieth century: MV=PT. Looking and acting strangely like another law of expansion and contraction (the ideal gas law, PV=nRT), Fisher’s equation locked money supply and price level together in a statement of identity:

MV=PT

M times V equals P times T, where

M stands for the “money supply”

V represents money’s speed (velocity) of circulation

P is the price level and

T stands for the volume of transactions.

That little equal sign said it all. If M expands, then P (or T) must increase (or V must decrease). With the assumption of constant velocity, Fisher’s “equation of exchange” became a theory that rendered the effect of an increased money supply on prices indisputable. The word “inflation” now could describe the behavior of either money or prices, since the two were always and everywhere inseparable. When, under the pressures of war and revolution, prices rose dramatically in Russia and Germany (1917–1923), few thought to compare those cases of political instability and monetary uncertainty to the experiences of the Confederacy. Instead, the quantity theory of money explained everything.

In the years following World War I, the frightening depreciation of Germany’s currency—news reported everywhere from major metropolitan newspapers such as the New York Times to small-town broadsheets like the Anaconda Standard (Montana)—made inflation (in the word’s new sense of “rising prices”) as topical for political historians as it had once been for naturalists. The Russian émigré classicist, Michael Rostovtzeff, revolutionized the study of the Roman Empire by attributing its decline to easy money and resultant inflation in the second century; Friedrich Hayek’s teacher, Ludwig von Mises, echoed this analysis and concluded that any empire must fall if it deviates from the requirements of a market economy (“sound” money chief among them).[9] By the 1970s, a signmaker in Detroit could personify inflation as a villain resembling both Batman’s Joker and Rocky and Bullwinkle’s Boris Badenov, while it was also alluded to in the opening credits of The Mary Tyler Moore Show, a popular sitcom.

During the Great Depression, Elmer Thomas, a Democratic senator from Oklahoma, had spoken positively of currency inflation as a means of cheapening the dollar and increasing prices—and his colleagues had agreed with him (the amendment he was supporting passed the Senate, 64–20). But Thomas’s enthusiasm for policies that would make “wheat go up in value, corn go up in value, cotton go up in value” and would make “every commodity of the field and the farm and the ranch and the lumberyard and the mine … share in the general prosperity” is hard to kindle in our contemporary context, when most Americans think of themselves as buyers not sellers, consumers not producers.[10]

As consumers, we may roll our eyes at the price of meat or gasoline, but our individual experiences count for little when it comes to making policy or even documenting reality. Instead, we know what inflation is thanks to another of Irving Fisher’s ingenious creations, the price index. Supervised in his Yale doctoral dissertation by the mathematical physicist, Josiah Willard Gibbs, Fisher had no doubt that “sooner or later, every true science tends to become mathematical.”[11] Of Fisher’s own preferred numbers and measurements, some—such as his calculation of the benefits of Prohibition—have now fallen into historical irrelevance and some—such as the figures he compiled to demonstrate the benefits of a national health insurance system—remain topics of heated political debate. Yet others—such as the eugenics research on the basis of which he concluded that immigrants from Southern and Eastern Europe were causing the American race to degenerate, the cranial measurements that advanced anthropological study, and the IQ tests he believed crucial for psychology’s emergence as a mature science—are now in wide disrepute. In contrast, Fisher’s idea of a “price index,” fine-tuned over the years by specialists, has been central to the definition of “the not-quite-natural not-quite-social space that came to be called ‘the economy.’”[12] Every month since 1920, the Bureau of Labor Statistics (BLS), dedicated by its first commissioner to the “fearless publication of facts,” has produced “two of the most widely watched monthly inflation indicators,” the Consumer Price Index and the Producer Price Index, alongside unemployment figures and other statistics.[13]

Begun in 1918 as a wartime intervention in labor relations—a way for the federal government to mediate between shipyard workers who cited rising food prices in their demands for higher pay and shipyard owners who argued that food prices were “unrepresentative” of the overall cost of living—the Consumer Price Index was in its first decades of existence repeatedly disputed. During World War II, for instance, the Bureau’s figures showed a 24 percent increase in prices while statistics compiled for the American Federation of Labor and the Congress of Industrial Organizations indicated nearly double that (43.5 percent). When the Bureau defended its numbers, these unions retorted: “No group of government bureaucrats has ever before had the audacity to insult America’s millions of housewives by telling them that their experiences are all wrong and that they should try instead to live on BLS statistics.” Others agreed. “Indexes,” stated the Chicago Sun in October 1943, “are inedible.”[14]

Since the 1980s, with the further mathematicization of economics, the triumph of Friedmanite monetarism, and (not least) the near complete collapse of labor unions, such challenges have become less common. No longer understood in economic contexts as the act of inflating something, “inflation” is instead a thing that exists out there in the world, a force to be feared and a possibility to dread. Most of us give little thought to how or by whom it is calculated and compiled. Yet the Bureau of Labor Statistics employs hundreds of field agents who spend their days going literally door-to-door as they gather price information from 23,000 retailers and service-providers and 50,000 landlords. The image of the BLS employee who goes shopping just as his or her precursor did in the 1940s is both charmingly old-fashioned and rather pathos-laden in the era of Big Data, “web scraping,” and the Billion Prices Project.[15] Meanwhile, the Federal Reserve Board (FRB) has its economists as well, who exclude all food and energy prices from their index of “core inflation.” While the FRB grants that these “make up an important part of the budget for most households,” it nonetheless bans them from its preferred indicator because prices for these items tend to be comparatively volatile. Observing that citrus fruit becomes expensive after an ice-storm or that gasoline prices rise and fall with the seasons (up in the spring, down in the autumn), the FRB argues that they tell us little about that aggregate variable in Fisher’s equation, the overall “price level.”[16] Too arcane a topic to engage many consumers, the different ways of calculating price variation leave an opening for today’s goldbugs, who scream that the Obama administration has fiddled its numbers, believe that inflation is actually soaring, and look forward to the coming demise of fiat currency.[17]

One could think about “core inflation” in other ways, though. If food and energy are part of anyone’s budget, they make up a far larger percentage of spending in lower-income households. Omitting these two items therefore helps ensure that the FRB’s policies respond more to the needs of bankers, lawyers, and politicians—those wealthy enough to be comparatively little affected by the “volatility” of grapefruits and gasoline—than to those with lower disposable incomes. Consumers (and the BLS’s field agents) may know that they are paying more but core inflation does not rise and so policymakers are little concerned. This is doubly worrying, given that core inflation “is largely indirectly determined by the growth of money wages and raw materials.” If the Consumer Price Index rises while core inflation remains steady, this means that consumer prices are increasing but wages are not. Low core inflation may chiefly mean stagnant incomes.[18]

The author wishes to thank Nick Cullather for his perceptive comments on an earlier version of this essay.

- Robert Shiller, “Why Do People Dislike Inflation?” in Christina and David Romer, eds., Reducing Inflation (Chicago: University of Chicago Press 1997), pp. 13–70; “Despite Public Fears, European Inflation Remains Tame,” Pew Research Center (16 May 2013), available at pewresearch.org.

- Edward D. Cope, “On the Systematic Relations of the Carnivora Fissipedia,” Proceedings of the American Philosophical Society, vol. 20, no. 112 (1882), p. 472.

- John Houston, “On the Structure and Mechanism of the Tongue of the Chameleon,” The Transactions of the Royal Irish Academy, vol. 15 (1828), p. 191; George Pilcher, “On the Effects of Scarlet Fever upon the Ear,” Association Medical Journal, vol. 3, no. 107 (19 January 1855), p. 52; J. S. Bowerbank, “On the Anatomy and Physiology of the Spongiadae,” The Philosophical Transactions of the Royal Society of London, vol. 148 (1858), pp. 286–287, p. 298.

- Bray Hammond, “The North’s Empty Purse, 1861–1862,” The American Historical Review, vol. 67, no. 1 (October 1961), pp. 1–18.

- Gary Pecquet, George Davis, and Bryce Kanago, “The Emancipation Proclamation, Confederate Expectations, and the Price of Southern Bank Notes,” Southern Economic Journal, vol. 70 (January 2004), pp. 616–630.

- The Nomination to the Presidency of Peter Cooper and His Address to the Indianapolis Convention of the National Independent Party (New York: Trow’s Printing and Bookbinding Co., 1876); Irwin Unger, The Greenback Era: A Social and Political History of American Finance, 1865–1879 (Princeton: Princeton University Press, 1964), p. 46.

- Andrew D. White, Paper-Money Inflation in France: How it Came, What it Brought, and How it Ended (New York: D. Appleton & Co., 1876), p. 65, pp. 67–68. When he re-issued the text during the 1896 presidential campaign, he added to it slightly; this later version was published under the title Fiat Money in France. For the author’s account of his many presentations on this subject, see The Autobiography of Andrew D. White (New York: The Century Co. 1905), vol. 1.

- The Nation (29 July 1875), p. 66; (30 September 1875), p. 209; (25 November 1875), p. 333.

- Michael Rostovtzeff, The Social and Economic History of the Roman Empire (Oxford; Clarendon Press, 1926); Ludwig von Mises, Human Action: A Treatise on Economics (New Haven: Yale University Press, 1949).

- Elmer Thomas, Forty Years a Legislator (Norman: University of Oklahoma Press, 2007), p. 97.

- Irving Fisher, “Mathematics in the Social Sciences,” The Scientific Monthly, vol. 30 (1930), pp. 547–557.

- Timothy Mitchell, Carbon Democracy: Political Power in the Age of Oil (London: Verso, 2011), p. 132.

- Carroll Wright, “The Working of the United States Bureau of Labor” (1904) approvingly cited in Janet Norwood and John Early, “A Century of Methodological Progress at the U.S. Bureau of Labor Statistics,” Journal of the American Statistical Association, vol. 79 (1984), pp. 748–761 and at bls.gov.

- Quoted in Thomas Stapleford, The Cost of Living in America: A Political History of Economic Statistics, 1880–2000 (Cambridge: Cambridge University Press, 2009).

- According to the project’s website at bpp.mit.edu “the Billion Prices Project is an academic initiative that uses prices collected from hundreds of online retailers around the world on a daily basis to conduct economic research.” The associate commissioner of the BLS has recently explained why the bureau does not cut all its field agents and rely on the BPP; see magazine.amstat.org.

- See federalreserve.gov but also dallasfed.org.

- See, for instance, shadowstats.com.

- Philip Arestis, John McCombie, and Warren Mosler, “New Attitudes About Inflation,” Challenge, vol. 49, no. 5 (September–October 2006).

Rebecca L. Spang teaches history at Indiana University, Bloomington, and is the author of The Invention of the Restaurant: Paris and Modern Gastronomic Culture (Harvard University Press, 2000). Her book on money and the French Revolution will be published by Harvard University Press in 2014.

Spotted an error? Email us at corrections at cabinetmagazine dot org.

If you’ve enjoyed the free articles that we offer on our site, please consider subscribing to our nonprofit magazine. You get twelve online issues and unlimited access to all our archives.