The Bonds of Catastrophe

Betting on disaster

D. Graham Burnett

It is perhaps not widely understood (outside the specialized domains of risk modeling and property insurance) that the last twenty years have seen the relatively rapid growth of a new kind of financial instrument: the catastrophe bond. I aim in what follows to offer the reader a brief introduction to these innovative money-things, which sit at the precarious nexus of mathematical modeling, environmental instability, and vast sums of capital. Techno-legal creations of considerable complexity (and some genuine elegance), “cat bonds” circulate in the Olympian air of global high finance, where they afford investors an opportunity to place large bets on the occurrence (and non-occurrence) of various mass disasters: earthquakes, hurricanes, plagues, suitcase nukes. The lengthy, turgid, and highly confidential specifications that make up the prospectuses of these investments might be said to represent a special and entirely overlooked subgenre of science fiction: what we discover, turning the pages of such deals, are fanatically extensive metrical descriptions of countless doomsday scenarios, each story told in lovingly legalistic and scientific detail. Unlike most dystopian fantasizing, however, the worst-case scenarios played out in the appendices of cat bond issues come with very real-world prospective paydays, precisely priced and proper to the consideration of an imaginative portfolio manager looking to diversify her investments.

Put your paranoia aside (at least temporarily). It is quite possible that cat bonds are basically a good thing, creating mechanisms as they do for hedging against the tremendously disruptive costs of low-probability, high-negative-impact natural and/or social events. It is also possible, of course, that they are simply another sophisticated exercise in plutocratic self-dealing. We will bracket that thorny problem for now, and focus here on conveying (1) a general understanding of how these instruments work, and (2) a specific appreciation of the way that they constitute perhaps the most elaborate and powerful social technology currently available for articulating just what we mean when we say “catastrophe.”

• • •

So what’s a cat bond? A cat bond is, first of all, a bond—meaning a kind of debt arrangement. The holder of any bond has conveyed a sum of money to the bond issuer for a fixed term (say, a year or two) in return for the promise of some sort of interest payment: You hold my hundred thousand dollars this year, but you promise that at the end of the year you are going to give me back, not a hundred thousand dollars, but a hundred and ten thousand dollars—netting me a 10% return on my investment. With an ordinary high-quality corporate or municipal bond, my odds of getting my principal back are pretty close to 100%, and my rate of return (given the near-negligible risk of loss) is generally pretty low. US Treasury bonds are about as minimal-risk an investment as the earth seems to afford at present (since they are backed by the American government, which, despite its problems, looks unlikely to evaporate anytime soon), and so whatever they are paying in a given year basically sets the baseline for investors everywhere: it’s a small rate of return but, for all intents and purposes, it’s guaranteed. By contrast, if I am buying a “junk” bond—issued by some business guys with wild eyes and big ideas—I am promised considerably bigger interest payments than I would get on a “T-bill” (a short-term US Treasury bond), but I have to weigh the non-zero probability of a default on the part of my debtors, who may in fact not only not pay me my nice premium, but could even lose some or all of my principal (though this is pretty rare in normal financial climates). That, in a nutshell, is the bond market: lend money to different folks, who have to promise to pay you more or less for the privilege of the loan, depending on how shady they look.

Catastrophe bonds have this basic structure. The holder of such a bond has indeed conveyed a sum of money to the bond issuer for a fixed term, in return for the promise of a downstream percentage premium. What makes a cat bond a cat bond, however, is that—unlike most ordinary bonds, which are issued by people/governments/institutions needing ready-to-hand money to build a building or a bridge or expand a business—a cat bond has been issued by somebody who is worried about some kind of possible disaster, somebody who is looking for protection from the financial effects of a catastrophe.

Think like a gigantic insurance corporation for a moment. If you’ve been writing property insurance for a large number of homeowners in southern Florida, you get pretty nervous every hurricane season. Yes, you’ve socked away everybody’s premiums for years and years, so you are sitting on a mountain of cash, but you still have to reckon with the fear that, in your competitive drive to underbid the other insurance companies writing policies in the Sunshine State, you may have left yourself inadequately capitalized in the event that a massive storm flattens the region. You would do well to hedge against that whopper, by basically buying some insurance yourself. And indeed, the “reinsurance” market—insurance for insurers—has been around for a long time, and amounts to a circa $500 billion business, whereby the financial risks of different large-scale insurable events are carved up and spread out among a sizable (but relatively cozy) community of mutually reinsuring insurers. This is all good old-fashioned insurance. Meaning, basically, contracts with the following form: “If you lose this under these conditions, I will pay you back for it.” It’s a big deal to take on that sort of obligation. You had better be sure you can do what you say you are going to do—or else you go bankrupt (and your clients get screwed).

In the wake of Hurricane Andrew in 1992 (to that point the costliest such storm in US history, tallying damages above $25 billion), the insurance and reinsurance industries were obliged to reckon with the fact that there might not actually be enough resources floating around in the entirety of the insurance universe to handle a really big storm. This was a scary thought, and it produced a good deal of hand-wringing, some soul-searching, various governmental committees and inquiries, and also some developments. Cat bonds can be understood as part of the resulting effort to bring more money (from new sources) into the quite private and arguably even arcane world of the big insurers.

The new source at issue in this case was the US capital market—meaning the $40 trillion or so that sloshes around in the liquid world of stocks and bonds under the jurisdiction of the US Security and Exchange Commission (SEC). There is no larger pool of money on the globe. Tapping it requires designing an instrument you can sell in that marketplace. And this is what the early cat bond innovators did: they designed relatively simple bonds that could be sold directly to (large, institutional) investors—bonds that permitted insurance companies to “rent” their risk to the market.

Here is an example of how such a bond works. Istanbul is a very large city that lies near a seismic fault. Big earthquakes have hit the place before, including one in 1509 that took down one of the towers of the Hagia Sophia and killed upwards of ten thousand people (contemporaries called it “The Little Day of Judgment”). There is currently Turkish legislation that mandates earthquake insurance for a large class of property holders in the city, and a kind of public-private entity (the “Turkish Catastrophe Insurance Pool,” or TCIP) that manages those policies. The TCIP is on the hook for a lot of money if the North Anatolian Fault takes another big slip, as it has a few times over the last five hundred years. So the TCIP goes to Munich Re (a large German reinsurance firm) and some other dealmakers, and together they design, market, and sell a cat bond. The bond promises to pay 2.5 percent per year (which, when bank-to-bank interest rates are below 1 percent, doesn’t look too bad), and investors can choose to leave their money with TCIP for one, two, or three years.1 TCIP promises to take all the money they get for the bonds (and they end up getting $400 million for them, since this paper sells like hotcakes in New York), and stick it in a dollar-denominated bank account in Germany, where it will just sit safely until the maturation date. There is only one kicker: if there is a big earthquake in Istanbul while your money is in that account, you can probably forget about your tidy 2.5 percent annual interest payment. In fact, you can probably forget about your million-plus principal investment too, because there’s a good chance TCIP is going to get to keep all your cash—and use it (at least in theory) to help pay off all the claimants they are about to see.

How big an earthquake? That is where things get interesting. Cat bonds are built with what are called “triggers”—meaning specific criteria under which the “cedant” (the party seeking to hedge their potential losses, in this case TCIP) gets to keep some or all of the value of the bond. There are several different kinds of triggers: some are keyed to specific financial losses on the part of the cedant (e.g., “if, for whatever reason, we have to pay out more than $100 million in claims in a given year, we get to keep the money you invested in our bond”); others are keyed to the industry as a whole, or some subsection of it (e.g., “if earthquake insurers in Western Europe face an event that requires total payouts above $10 billion across the sector, we get to keep your money”). But the most interesting triggers are those that that are keyed to the specific metrical parameters of a prospective disaster. These are called “parametric” triggers, and they constitute a remarkable convergence of geophysical and financial modeling. In such trigger systems, the mathematics of meteorological, seismographic, and even epidemiological analysis is used to create spreadsheet disaster projections that are at the same time odds tables in a kind of high-stakes pari-mutuel pool. Think of it as something like off-track betting on global catastrophes.

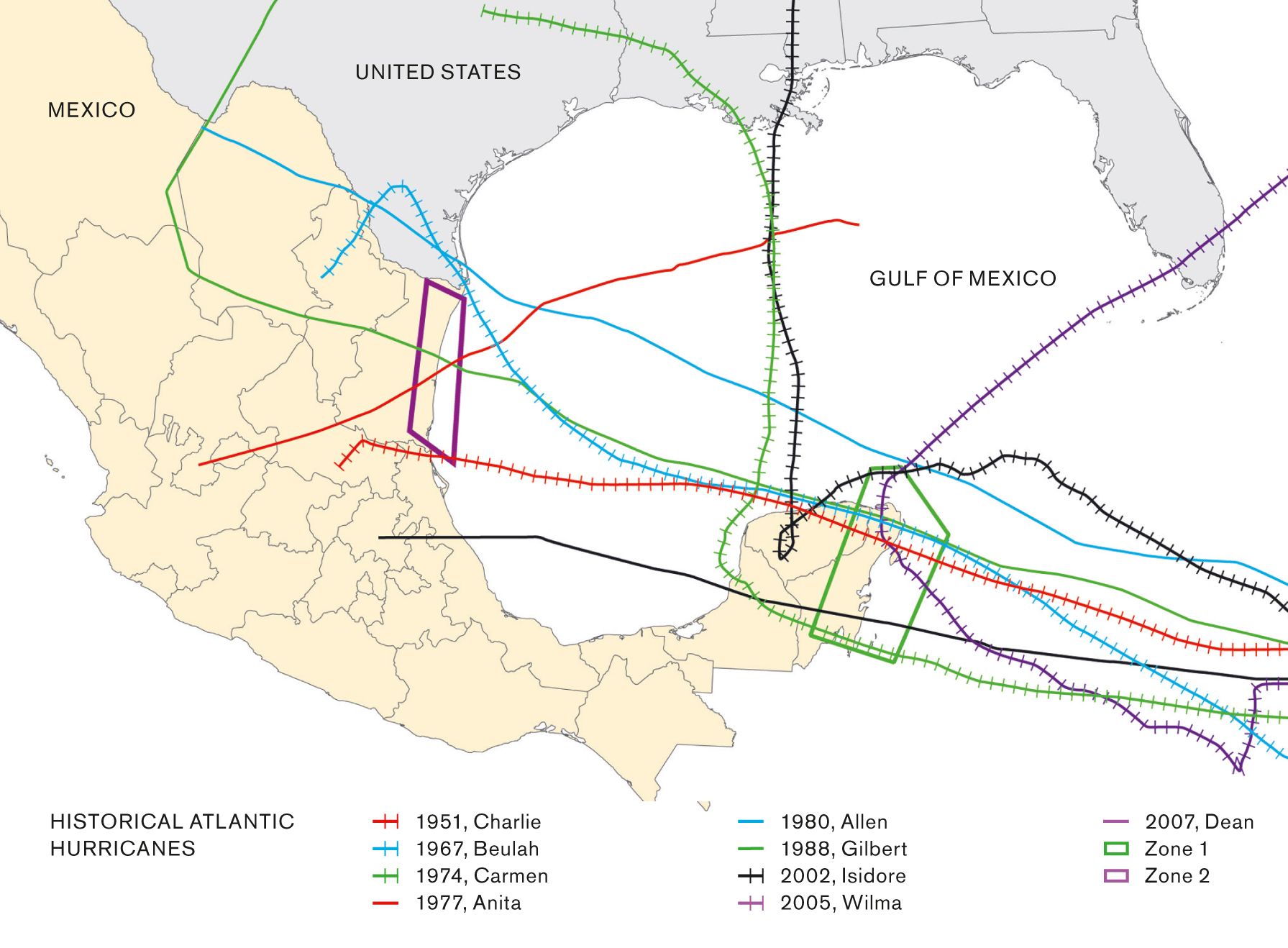

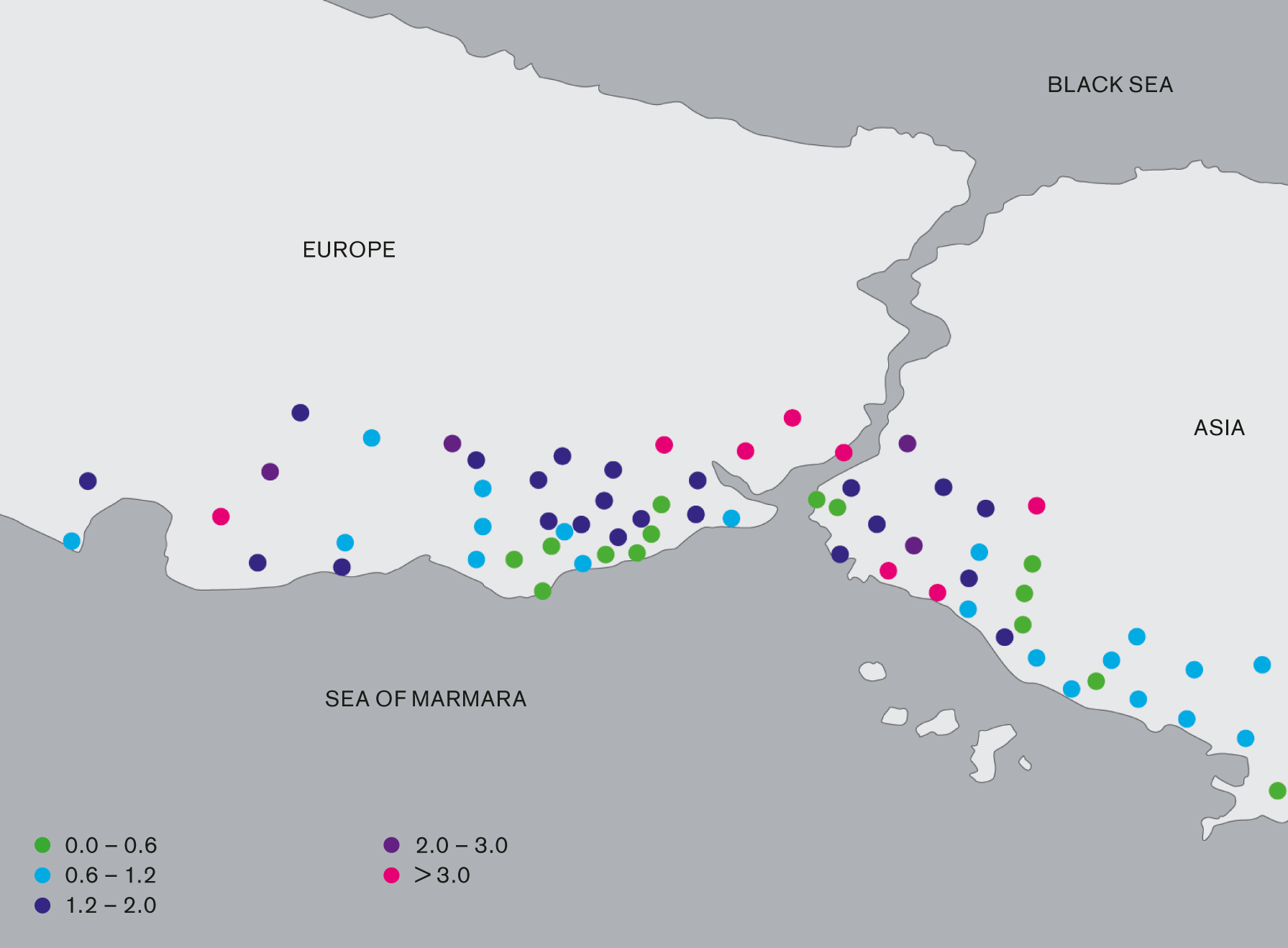

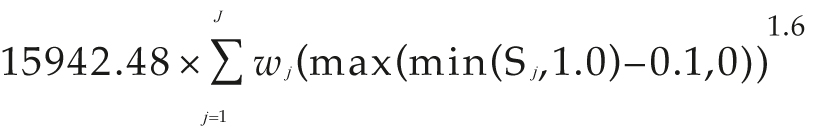

What do parametric triggers look like? The figure above, which has been taken from the prospectus for TCIP’s actual cat bond prospectus (Bosphorus 1 Re Ltd.), depicts a schematic map of the Bosphorus, speckled with small, multicolored dots in and around the major urban areas of Istanbul.2 Those dots represent seventy seismographic monitoring stations that are part of a global network of strong motion seismometers in urban areas. The colors here represent a weighting code, by which each station is given more or less significance in the following summation:

Here, “j” is the number of a specific monitoring station (J=70), “wj” is the weighting factor for a given station j (the range of these values is given in the key at the bottom of the figure), and “Sj” is the reported “spectral acceleration” for a given earthquake event at station j (spectral acceleration is a standard unit for measuring the effect of an earthquake at a given point).

The earth suddenly trembles, and then slips precipitously out in the lovely Princes’ Islands off the southern coast of Istanbul. Calamity. You are a hedge fund manager in Westport, Connecticut, who holds a lot of Bosphorus 1 Re Ltd. cat bonds. You turn down the sound on CNN, and log onto the GIS website address given in your bond prospectus to pull down the reported quake numbers. You plug them into the formula above and do the arithmetic. If the resulting number is larger than 2,412, you just lost everything.3

• • •

Why such a complicated formula? Why not a nice simple trigger, like, “If there is an earthquake bigger than 7.4 on the Richter Scale, the epicenter of which is within the city limits of Istanbul, then TCIP gets your money”? There have indeed been much simpler parametric triggers than the multi-input, weighted model at the heart of Bosphorus 1 Re Ltd. For instance, one of the earliest large cat bonds, called Concentric Ltd., was issued by Tokyo Disneyland in 1999, and it spelled out a straightforward set of three concentric rings around the Magic Kingdom: a quake of 6.5 (measured in the Japanese seismic units) in the inner circle, or 7.1 in the middle ring, or 7.6 in the outer one tripped the switch—conveying the escrowed $100 million to Mickey’s keepers. But the evolution of the cat bond industry has tended in the direction of increasingly complex parametric triggers.4 This can be understood to reflect the increasing complexity of the modeling systems that are used to structure these deals. On the one hand, there are a number of different hurricane and seismological models that can be used (largely on the basis of data about historical storms and earthquakes) to project conceivable atmospheric and geotectonic cataclysms, and to assess (at least notionally) associated risks and probabilities. On the other hand, there are various portfolio models that insurers and investors use to analyze their liquidity under different economic and market conditions. Intricate parametric triggers for cat bonds sit at the hinge of these two worlds.5 For instance, the weighting of the different seismological monitoring stations in Bosphorus 1 Re Ltd. reflects, one must presume, the relative magnitude of TCIP’s financial exposure in each zone: higher weightings in the formula would appear to correlate with a higher-density of higher-value insurance obligations (though without access to TCIP’s books, it is difficult to assert this with certainty).

In this sense, the formula at the heart of Bosphorus 1 Re Ltd. reflects a meticulously crafted mathematical description of a very specific natural- social event: an expensive earthquake. An earthquake is an earthquake, but an expensive earthquake is a catastrophe. Hence,

should be understood as the way you say, in the computational patois of late capitalism, “a catastrophe in Istanbul.”

• • •

What about the human dimension of the catastrophic? Yes, you may also wager on mass death (and not merely on catastrophic property loss). For instance, the spring of 2015 saw the rapid sale of 285 million euros’ worth of mortality cat bonds issued by Benu Capital Ltd., a shell company incorporated in Ireland (the cedant is AXA Global Life, Paris-based banking and insurance conglomerate). This bond is triggered by “excess mortality” in France, Japan, and/or the US over a five-year period ending in 2019. The exact details of the trigger model are not public, but the placement and structuring agents for the instrument have reported that the “Class A notes will trigger at a mortality index level of 116% for France, 116% for Japan and 108% in the US,” and that the Class B notes (the riskier tranche) “will trigger at a mortality index level of 108.1% for France, 108.2% for Japan and 104.1% in the US” Without being able to examine the underlying model, however, it is difficult to say exactly how these modestly elevated mortality rates would need to “manifest” in the relevant populations in order to trigger the bond, since the mortality index in use in the instrument is apparently weighted by age and gender in each covered region. The A Class notes pay 2.55%, and the B notes 3.35%.

Is this a good bet? In some sense, the market says it is, in that the offering was expanded from its initial prospectus, and even the larger issue promptly sold out. At the same time, it is perhaps worth pointing out that one of the rating agencies (Standard & Poor’s) explicitly noted, in its rating report on the issue, the impossibility of meaningfully “modeling” all the potential events in a mortality transaction. For instance, a large tsunami, or terrorist attack, or pandemic, or the outbreak of a new Sino-Japanese war would all stand a very good chance of triggering the bond—and yet it is obviously very hard to put credible odds on such a basket of monstrous singularities.6 What the successful sale of Benu Capital’s bond can be said to “mean” however, is something like the following: a small coterie of the masters of the universe, sitting around tables in tall glass buildings, think they know (well enough) how likely it is that lots of us will suddenly die in the next few years. And they have backed up their wager with gigantic piles of money.

• • •

Let’s return, in closing, to the paranoia—if just for a moment. On the one hand, there is something undeniably unsettling, I think, about cliques of billionaires placing large-stake bets on mass death. And there is something additionally troubling, perhaps, about many of the most sophisticated scientists of the earth and atmosphere taking on paid employment as bookies to a members-only numbers game played with global catastrophes. On the other hand, if there actually is, say, some horrible pandemic that sweeps across Japan, there are going to be a lot of ordinary people expecting to receive (and needing) payout from their life insurance policies. And if AXA Global Life goes bankrupt, many of them are likely never to see those payouts. Whereas if Benu Capital’s cat bond triggers, AXA may be able to meet its obligations, and the impact of those sudden costs will be distributed across a broad pool of large-scale investors (who will simply have to write down some investment losses).

On the one hand, on the other hand. Perhaps it will have to suffice, in a short essay like this one, merely to state that the moral-cum-financial problem at issue in these instruments affords an interesting touchstone for any theory of wealth and social welfare. The problem is left to the reader.

Though that might be a bit too anodyne. After all, a dark and recursive specter haunts our topic: the vast aggregations of capital that are at play in the cat bond industry are themselves inextricable from the titanic, corporate-industrial refiguring of our planet—its external features, climatological dynamics, and even internal architecture. Which is to say, there is mounting evidence that the historical evolution of the “anthropocene” ought to be understood as a non-trivial component of what we still tend to think of, reflexively, as “natural” catastrophes. Or, to put it another way, it would seem that human beings—and specifically the wealthiest humans on earth—are in the process of creating a significant drift toward climatological and terrestrial changes that are increasing the frequency and intensity of disruptive natural-social calamities on our planet. Indeed, some specific corporate entities are large enough in themselves to be meaningful drivers of such changes. Upon which those same entities are now in a position, potentially, to capitalize, by means of well-placed cat bond bets. Which, looked at this way, amount to bets on a game in which they are actual players.

Outlandish? We will see.

- Technically, the money is not left “with” TCIP, but with a “Special Purpose Vehicle” (SPV), a kind of shell company that exists exclusively for the purpose of holding the assets in question and discharging, across the term of the bond, the obligations occasioned by its prospectus. The actual structuring of these deals has much to do with the small print aspects of international tax law and corporate finance. The account given in the text here is schematic. For details, see Pauline Barrieu and Luca Albertini, eds., The Handbook of Insurance-Linked Securities (West Chichester, UK: John Wiley and Sons, 2009).

- I was surprised, in doing this research, by the level of confidentiality that surrounds cat bond documentation. Most of the individuals who work with the actual offering circulars and prospectus materials have been obliged to sign non-disclosure agreements, and are therefore unwilling to share the specifics of these instruments, which are not subject to the obligatory public filing requirements of the SEC because they are not available to ordinary retail investors. The concern with secrecy is largely a function of a legal culture at banks and insurers—a culture that frets about liabilities and obsessively protects what could be construed as intellectual property. I was able to find several individuals in the industry who, on being assured anonymity, were willing to convey copies of some of the relevant documentation. This piece would not have been possible without their assistance, which is gratefully acknowledged here. Further thanks to Sophia Li and Aaron Hirsh.

- For the record, only a very small number—roughly half a dozen—of the several hundred cat bonds issued since the mid-1990s have actually triggered (and not all triggering events occasion total loss of the principal invested in the bond, since some bonds are designed with different levels of loss pegged to different trigger levels).

- Though it should be noted that the use of parametric triggers in cat bonds saw a brief hiatus in the period 2010–2014, for reasons that are debated among industry insiders. In general, cedants prefer “indemnity” triggers (triggers that are keyed to specific losses from an insurer’s book), because they eliminate—at least in principle—what is called “basis risk,” meaning the risk of differences between the insurer’s obligations in an insurable event and the pay-in afforded by a triggered cat bond. It is ideal, for the cedant, if these match up dollar-for-dollar, but no parametric trigger, however precisely tuned, can insure a perfect fit with the particular losses an insurer will ultimately face in a given situation. (Basis risk can, of course, go both ways, and it is possible for a cedant to end up receiving more money from a triggered cat bond or other reinsurance relationship than the cedant is actually obliged to pay out to its policy holders in a given insurable event.) Parametric triggers, which appear to be back on the upswing in the last year, have always had an appeal for investors, in that they are arguably more transparent/objective than indemnity triggers (since the latter are contingent on the cedant’s bookkeeping). It is perhaps worth adding that parametric triggers in insurance contracts predate the emergence of the cat bond industry itself, but information on how and where they were used is difficult to secure, given the even more private nature of the traditional insurance business.

- A small number of companies specialize in the computer models that lie at the center of the cat bond industry, the most important of which are AIR Worldwide, RMS (Risk Management Solutions), and EQECAT (now part of CoreLogic, a large, global property information and analytics corporation). These firms employ considerable numbers of scientists and programmers who design, maintain, and retail the use of specialized risk-analyzing software (most of it derived from weather and seismographic models produced in academic settings). What is striking to an outsider is the extent to which these systems dominate the configuration and assessment of any given cat bond deal. Both buyers and sellers (and even the notionally independent rating agencies) tend to rely to a considerable degree on the same (or a very similar) model, and sometimes even on the same appendix of projected risk analysis. This seems quite remarkable, in view of how speculative much of this modeling is—historical data tends to be very limited, and the calculation of probabilities for unique, multivariable events is a highly uncertain affair.

- Details of the Benu Capital deal are courtesy of Steve Evans’s Artemis website (www.artemis.bm), the primary clearinghouse for publicly available information about the cat bond industry.

D. Graham Burnett is an editor of Cabinet and teaches at Princeton University. He, Jeff Dolven, and Asad Raza are organizing the Tivoli Park Workshop at this year’s Ljubljana Biennial.

Spotted an error? Email us at corrections at cabinetmagazine dot org.

If you’ve enjoyed the free articles that we offer on our site, please consider subscribing to our nonprofit magazine. You get twelve online issues and unlimited access to all our archives.