Unpaid Debt

The Freedman’s Bank and the abandonment of Black America

Yong Kwon

No people can well rise to a high degree of mental or even moral excellence without wealth. A people uniformly poor and compelled to struggle for barely a physical existence will be dependent and despised by their neighbors, and will finally despise themselves.

—Frederick Douglass

On May 29th, the fourth day of nationwide protests against racialized police brutality, protesters in Washington, DC sprayed graffiti on the walls of the Treasury Department annex on Lafayette Square called the Freedman’s Bank Building. Lost in the dramatic images of subsequent government reprisals and acts of civic resistance in the nation’s capital, the news media paid little attention to this small outpouring of public frustration. But the defacement of the Freedman’s Bank Building—named for an institution that once stood on the site—carried deep historic resonance: a remonstrance against the US government’s repeated abandonment of the Black community during economic crises.

The US government is capable of commendable foresight when it wants to be. In spring 1865, the Lincoln administration anticipated a major humanitarian crisis as the collapse of the Confederacy became self-evident. Approximately four million Black people were expected to be emancipated, but these former slaves would become free people without property or capital. In this environment, two outcomes seemed likely for this soon-to-be internally displaced population: their return to coercive labor for subsistence or widespread starvation.

In response to this looming crisis, Congress established the Bureau of Refugees, Freedmen, and Abandoned Lands. This new agency was instructed to distribute food, clothing, and fuel to the newly emancipated population. In addition, this “Freedmen’s Bureau” would establish hospitals and schools that would provide publicly funded services to Black communities. Perhaps most radically, Congress authorized the bureau and the army to divide abandoned and confiscated Southern plantations into forty-acre plots for eventual sale to ex-slaves.[1]

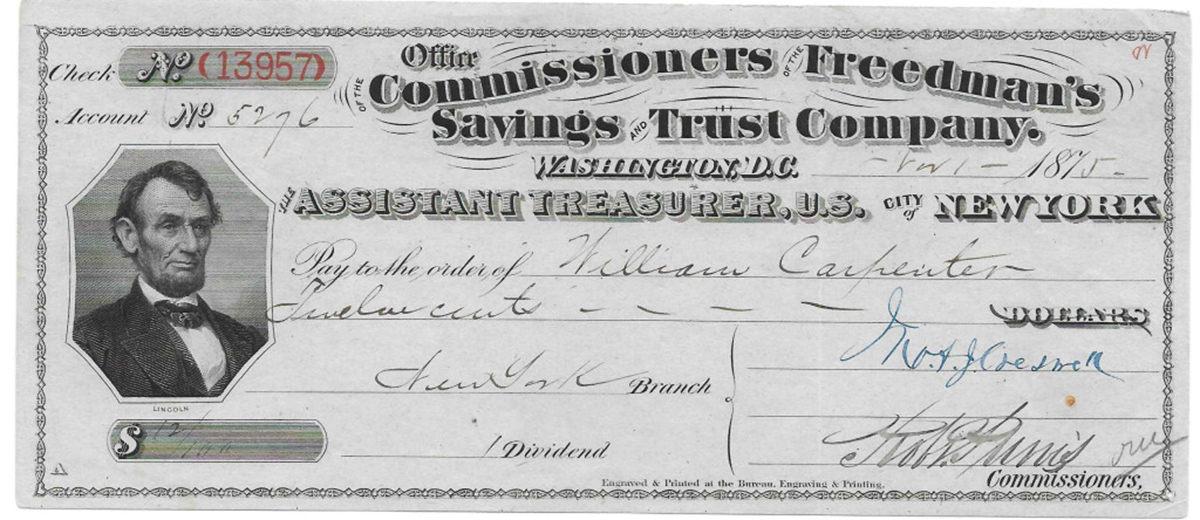

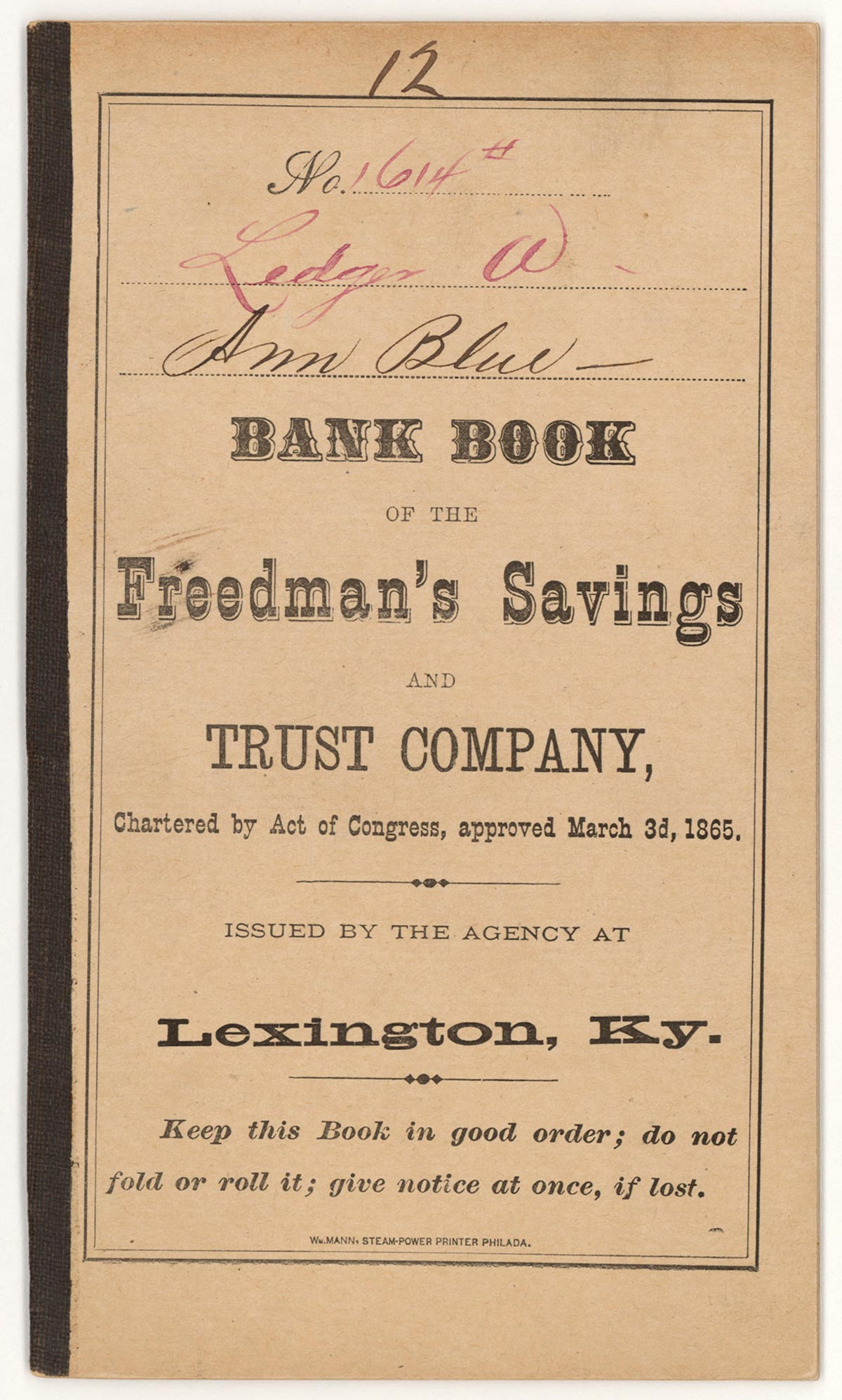

Anticipating that this new class of independent Black farmers would need a financial institution to help mobilize capital for this eventual purchase, Congress also chartered a bank in March 1865: the Freedman’s Savings and Trust Company. Although this “Freedman’s Bank” was intended to be the financial engine at the heart of Reconstruction, the project was hampered by racism and paternalism almost as soon as it was launched. The promise of forty acres and a mule evaporated with President Andrew Johnson’s vehement opposition to the creation of a Black yeoman class in the South. The Bank’s stated mission instead became teaching ex-slaves the lessons of “thrift,” “industry,” and “care for the future.” And its charter mandated that the bank use two-thirds of the deposits to invest in government bonds, which meant that savers would not be able to earn high interests or borrow from the bank to invest in their own commercial enterprises.[2]

Nonetheless, the bank was phenomenally popular and its revolutionary potential should not be understated. Thousands of Black citizens made deposits—the majority of accounts were under fifty dollars and some opened savings accounts for their children with only a few pennies. Records from the bank show that depositors were workers of all types: day laborers, house servants, farmers, mechanics, washerwomen, etc. At the Charleston branch of the Freedman’s Bank, deposits grew from 18,000 dollars in 1866 to 350,000 dollars from 5,500 depositors by 1873.[3] In fact, the bank was so successful in attracting savers that W. E. B. Du Bois (presumably sardonically) commented that “the proverbial thriftlessness of the Negro seemed about to be disproven.”

At a practical level, the bank also served to connect family members who were forcibly separated by the slave trade. By using the branch offices of the Freedman’s Bank, a person in Virginia could, for instance, send cash to their relatives who now lived in Mississippi because they were trafficked there before the end of the war. It also provided a rare avenue for Black women to assert their independence. At a time when the law gave husbands the right to sign their wives’ labor contracts and collect payment of their wages, Black women, married as well as single, were able to open individual accounts at the Freedman’s Bank without the signature of a husband or a male relative.[4]

Between 1865 and 1874, approximately one hundred thousand Black workers entrusted some fifty million dollars to the bank—equivalent to one billion dollars in today’s currency.[5] Ironically, this success became the harbinger for the institution’s downfall—it attracted the attention of financial speculators. They were America’s first investment banks, predecessors of Lehman Brothers and Goldman Sachs, looking for money to borrow and invest in the burgeoning railway industry. Bending to pressure from these monied interests, Congress ultimately amended the charter of the Freedman’s Bank in 1870 to allow half of the deposits that were originally earmarked for government bond purchases to be invested elsewhere.

Immediately, there was a mad race to borrow from the bank. Overwhelmed by the market’s demand for capital and blinded by the promise of high returns, the bank’s board—which remained entirely white despite serving depositors who were uniformly Black—made a series of reckless loans. The largest of these went to the most prominent investment banker of the era, Jay Cooke, who borrowed a total of five-hundred thousand dollars to finance the Northern Pacific Railway. But overleveraged on debt, the Northern Pacific Railway company declared bankruptcy in September 1873 when it came under pressure from the US government’s decision to rein in the supply of money in the economy. This not only triggered the Panic of 1873, but also pushed the Freedman’s Savings Bank to the brink of insolvency.

Hoping that a well-known Black icon might invite savers to deposit more money and save the institution, the bank’s board persuaded the famed abolitionist Frederick Douglass to become its president. But realizing the depth of the bank’s losses, Douglass instead sought federal funds to reimburse depositors. He reasoned that the Black community had entrusted the bank with the first real wealth that they had ever owned because army officers and officials of the Freedmen’s Bureau championed the bank, implicitly signaling a federal guarantee. Therefore, Douglass argued, the US government bore a responsibility to its savers. But Congress responded with indifference—perhaps because there had not been a precedent for the federal government to rescue an individual bank or compensate its depositors for lost savings. One critical undercurrent was the Republican Party’s growing weariness with the mission and cost of Reconstruction—the Freedmen’s Bureau had already ceased operations by 1872.

When the bank was eventually liquidated in 1874, only half the depositors received any compensation—an average of $18.51 per person, or three-fifths the value of their accounts.[6] The remainder, including many who did not know that they had to send their bankbooks to Washington DC to collect their payouts, received nothing. This was Black America’s first interaction with the financial market. Many of the victims of this bank failure would never trust the banking system for the rest of their lives, critically impeding the process of wealth accumulation

Political apathy is inextricably tied to the failure of the Freedman’s Bank. And just as financial instability in 1873 revealed Congress’s disinterest in Black wealth, today’s crises also bring the persistent discrimination into stark relief. Case in point: even as the Treasury Department distributed 250 billion dollars to bolster the balance sheets of several large banks during the 2008 financial crisis, the government chose not to rescue two—ShoreBank and Carver Bank—that primarily focused on serving the Black community. In the end, these financial institutions were dismembered and sold to a consortium of larger banks.

The neglect of these and other minority-focused banks had both immediate and long-term consequences for the wellbeing of Black Americans. The National Community Reinvestment Coalition calculated that loans to Black-owned small businesses declined from an already-meager 8 percent of the national total to 3 percent during the 2008 recession.[7] Eight years later, as some economists hailed the “recovery” of the American economy, the proportion of the loans going to Black small business owners remained unchanged from the recession trough. As a result, only 2.1 percent of small businesses with employees were Black-owned in 2016 despite African Americans representing 12.6 percent of the population.

There are troubling parallels between the fate of the Freedman’s Bank and that of ShoreBank and Carver Bank. The common theme is the US government’s failure to extend assistance when these financial institutions and the communities they serve face systemic crises. This pattern of neglect helps explain why Black Americans today still only own 1 percent of the country’s total wealth—and how racial discrimination in the United States extends far beyond police brutality. The defacement of the Freedman’s Bank Building in May 2020 could not fully demonstrate the enormity of the economic suffering that the Black community has endured, but it provides an opportunity to consider this long history of injustice.

- Eric Foner, Reconstruction: America’s Unfinished Revolution, 1863–1877 (New York: Harper Perennial, 2014), p. 69.

- Mehrsa Baradaran, The Color of Money: Black Banks and the Racial Wealth Gap (Cambridge, MA: The Belknap Press of Harvard University Press, 2017), p. 24.

- W. E. B. Du Bois, Black Reconstruction in America: 1860–1880 (New York: The Free Press, 1998), p. 416.

- Eric Foner, Reconstruction, p. 88. Although more Black women were wage earners than their white peers, and therefore needed banking services, the American banking industry as a whole exclusively catered to men until the early twentieth century. The assumption that women were unable to manage large cash transactions is most visible in the absence of female bank tellers until World War II. A legal guarantee for all women to independently open a bank account would not be extended until the 1974 Equal Credit Opportunity Act.

- Richard White, The Republic for Which It Stands: The United States during Reconstruction and the Gilded Age, 1865–1896 (New York: Oxford University Press, 2017), p. 265.

- Eric Foner, Reconstruction, p. 532.

- Amber Lee, Bruce Mitchell, and Anneliese Lederer, “Disinvestment, Discouragement and Inequity in Small Business Lending,” (undated), National Community Reinvestment Coalition. Available at ncrc.org/disinvestment.

Yong Kwon is an economic historian and editor at Fellow Travelers Blog, a project that explores and advances left foreign policy proposals. He is also the director of communications at the Korea Economic Institute of America. The views expressed in this article are his.

Spotted an error? Email us at corrections at cabinetmagazine dot org.

If you’ve enjoyed the free articles that we offer on our site, please consider subscribing to our nonprofit magazine. You get twelve online issues and unlimited access to all our archives.